As a trader, it is essential to have a solid trading plan and risk management strategy. One of the most important elements of a risk management plan is a stop loss.

A stop loss is a preset order that automatically closes a trade when the market reaches a specified level. In this article, we’ll explore the importance of stop-loss orders for traders, and learn how to set the perfect stop-loss in 2023.

We’ll cover everything from the basics of stop loss orders to more advanced strategies for setting stop losses that can help to improve your trading results.

Whether you’re a beginner trader just starting out, or an experienced professional looking to take your trading to the next level, this article is for you.

By the end of it, you’ll have a solid understanding of why stop-loss orders are important, and how to use them effectively in your trading. Plus, we’ll also show you the step-by-step process of setting up a stop loss order in Zerodha.

So, grab a cup of coffee (or tea), and let’s dive in!

- What is a Stop Loss?

- Why is a Stop Loss Order Important – Should I use a Stop Loss Order?

- Different Types of Stop Losses

- How to Find the Ideal Stop Loss Level

- How To Set Stop Loss Order in Zerodha

- How to Set a Stop Loss for Different Trading Strategies?

- Tips for Using Stop Losses Effectively

- Conclusion

- FAQ – Frequently Asked Questions

What is a Stop Loss?

At its most basic level, a stop loss is an order that automatically closes a position when the price of an asset reaches a certain level. It’s a way to limit your losses and protect your capital by ensuring that you exit a trade before the price drops too far.

In trading, losses are inevitable. Even the most experienced traders make losing trades from time to time. The key is to limit those losses and protect your capital so that you can stay in the game over the long term. That’s where a stop loss comes in.

A stop loss is essentially an insurance policy for your trades. By setting a stop loss, you’re ensuring that you won’t lose more than a predetermined amount if the trade goes against you. It’s a way to manage your risk and protect your capital.

Why is a Stop Loss Order Important – Should I use a Stop Loss Order?

A stop-loss order is necessary for any trader because it helps to limit potential losses and protect their trading capital. Without a stop-loss order, traders may become emotionally attached to a trade and refuse to exit, leading to larger losses than anticipated.

A stop-loss order helps to take the emotion out of the equation and ensure that traders exit the trade when the time is right. Additionally, a stop-loss order is an essential part of any risk management strategy, helping traders to balance risk and reward and avoid taking on too much risk.

There are several reasons why a stop loss is an essential tool for any trader:

1. Limiting Losses

The primary benefit of using a stop loss is that it limits your losses. By setting a stop loss, you’re defining your maximum acceptable loss for a trade. If the price of the asset reaches this level, the trade will be automatically closed, limiting your losses.

This is important because losses are inevitable in trading, and even experienced traders make losing trades. The key is to limit those losses and protect your capital so that you can stay in the game over the long term.

By using a stop loss, you’re protecting yourself against unexpected events and minimizing the impact of losing trades.

2. Protecting Capital

By limiting your losses, a stop loss also helps to protect your capital. This means that you’ll have more money available for future trades, increasing your chances of success over the long term.

Protecting your capital is particularly important if you’re trading with a small account balance. Large losses can have a significant impact on your ability to trade effectively, so it’s important to limit those losses and protect your capital as much as possible.

3. Reducing Emotional Trading

Without a stop loss, it’s easy to become emotionally attached to a trade and refuse to exit, even when the price is dropping. This can lead to larger losses than anticipated and can make it difficult to stay objective when making trading decisions.

By using a stop loss, you’re taking the emotion out of the equation and ensuring that you exit the trade when the time is right. This helps to avoid impulsive decisions and reduces the impact of fear and greed on your trading decisions.

4. Allowing for Risk Management

A stop loss is an essential part of any risk management strategy. By setting a stop loss, you’re managing your risk and ensuring that you’re not taking on more risk than you can handle.

Risk management is important for maintaining a healthy trading account, avoiding impulsive decisions, and improving your chances of long-term success as a trader.

By using a stop loss, you’re balancing risk and reward and making trades that are appropriate for your trading style and goals.

5. Increasing Confidence

Finally, using a stop loss can increase your confidence as a trader. By limiting your losses and protecting your capital, you’ll be more confident in your ability to trade effectively over the long term.

This can help to reduce the impact of losses on your mindset and help you to make more rational trading decisions. By using a stop loss, you’re improving your chances of success over the long term and minimizing the impact of losing trades.

Different Types of Stop Losses

There are several types of stop losses available to traders, each with its own advantages and disadvantages:

Fixed Stop Loss

A fixed stop loss is the simplest type of stop loss. It’s set at a fixed price level, which is usually determined based on technical analysis or other indicators.

For example, if you’re long on a stock and it’s currently trading at Rs.50, you might set a fixed stop loss at Rs.45, which would trigger a sell order if the price drops below that level.

Fixed-stop losses are easy to understand and implement, but they can be vulnerable to market volatility. If the price drops suddenly and your stop loss is triggered, you could end up selling at a lower price than you intended.

Trailing Stop Loss

A trailing stop loss moves with the price of the asset, trailing behind it at a fixed distance. This means that if the price goes up, the stop loss will move up with it, ensuring that you protect your profits while also limiting your losses.

For example, if you’re long on a stock that’s currently trading at Rs.50 and you set a trailing stop loss of 5 points, the stop loss will move up with the price of the stock.

If the stock rises to Rs.55, the stop loss will move up to Rs.50, ensuring that you lock in a profit of 5 points. If the stock then drops to Rs.50, the stop loss will be triggered, and you

How to Find the Ideal Stop Loss Level

Finding the ideal stop-loss level for your trades can be quite challenging at first. But when you have a solid trading plan in place that has a fixed risk-to-reward ratio, you can buy a certain number of quantities of a stock and set a stop-loss order for a specific price.

This will ensure you only lose a pre-determined amount and always maintain your risk-to-reward ratio, which is essential for any trader to succeed in the long term.

Here are some other ways to help you find the ideal stop loss level for your trades:

Technical Analysis

One of the most common methods for determining the best stop loss level is through technical analysis. Technical analysis involves studying charts and using indicators to identify trends and price movements.

When using technical analysis to determine the best stop loss level, traders typically look for support and resistance levels. Support levels are areas where the price has previously bounced back up from, while resistance levels are areas where the price has previously failed to break through.

Traders can use these levels to set their stop loss orders, as a break below the support level or above the resistance level could indicate a trend reversal. By setting the stop loss order just below the support level or above the resistance level, traders can limit their losses while still allowing for potential gains.

Volatility

Another factor to consider when determining the best stop loss level is volatility. Volatility refers to the degree of price movement for a given asset over a period of time.

More volatile assets may require wider stop loss levels to account for the larger price movements. On the other hand, less volatile assets may require tighter stop loss levels to avoid being triggered by normal price fluctuations.

Traders can use the average true range (ATR) indicator to determine the appropriate stop loss level for a given asset based on its volatility.

Timeframe

The timeframe of the trade is also an important factor to consider when determining the best stop loss level. Shorter timeframe trades may require tighter stop loss levels to avoid being triggered by normal price fluctuations, while longer timeframe trades may require wider stop loss levels to allow for larger price movements.

Traders can use their trading strategy and risk management plan to determine the appropriate stop loss level based on the timeframe of their trade.

Risk Management

Finally, risk management should always be a key consideration when determining the best stop loss level. Traders should consider their risk tolerance, the size of their trading account, and their trading goals when setting their stop loss orders.

By balancing risk and reward, traders can determine the appropriate stop loss level that allows for potential gains while limiting potential losses.

How To Set Stop Loss Order in Zerodha

Setting a stop loss order in Zerodha Kite Terminal is a simple process. Here are the steps you need to follow:

Step 1: Log in to Zerodha Kite Terminal

Log in to your Zerodha Kite Terminal account using your login ID and password.

If you don’t have a DEMAT account with Zerodha yet, click the button below to open a Demat Account now!

Step 2: Select the Stock

Select the stock you want to trade by clicking on the name of the stock. In this example, we want to set a stop loss order for “HDFCBANK” shares.

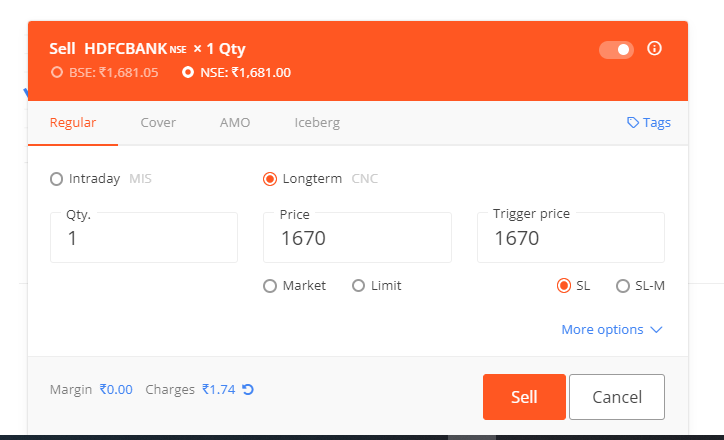

Step 3: Select the Order Type

Select the order type as “SL” (Stop Loss) from the bottom right side of the menu.

Step 4: Set the Trigger Price

Now, you can set the trigger price, which is the price at which the stop loss order will be activated. In this case, we want to sell the stock as soon as it touches Rs.1670. So our trigger price is the same.

Step 5: Set the Stop Loss Type – Market or Limit

Now, you can choose to set a stop loss order at market price or limit price. We recommend setting a stop loss order at market price, because in case of a sudden down move, a limit SL order might not be filled, thus increasing your losses and overall risk. Whereas a market order has very high chances of being triggered.

But, if you want, you can set a limit price for your stop loss order by selecting the “SL-M” order type and then adding the price you want to exit at.

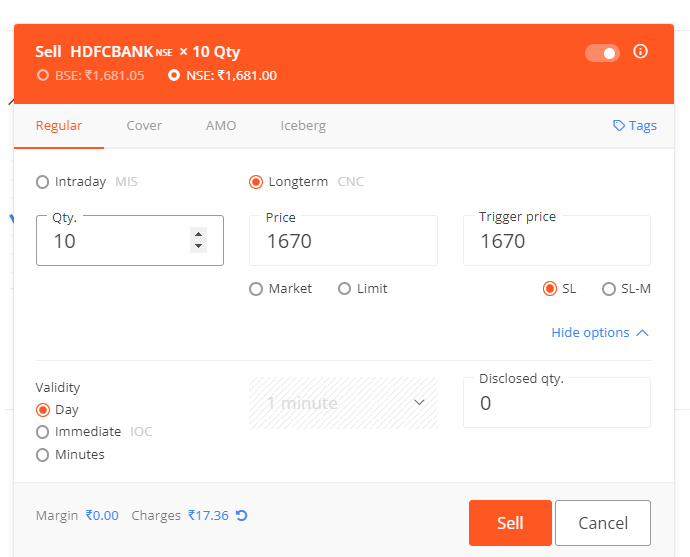

Step 6: Select the Quantity

Finally, select the quantity of shares you want to sell.

Step 7: Place the Order

Once you have set all the parameters, click on the “Place Order” button to place your stop loss order. You will get a notification that your SL order has been placed.

You can also check on the status of your SL order in your orders section. That’s it!

How to Set a Stop Loss for Different Trading Strategies?

Different trading strategies require different stop-loss levels. Here are some examples:

Day trading

Day traders typically use a tight stop loss to limit losses and exit trades quickly. A tight stop loss ensures that you don’t lose more than a predetermined amount if the trade goes against you.

For example, if you’re day trading a stock that’s currently trading at Rs.50, you might set a stop loss at Rs.48, which would trigger a sell order if the price drops below that level.

Swing Trading

Swing traders may use a wider stop loss to allow for more volatility and hold positions for longer periods. A wider stop loss gives the asset more room to fluctuate while still protecting your capital.

For example, if you’re swing trading a stock that’s currently trading at Rs.50, you might set a stop loss at Rs.45, which would give the stock more room to move before triggering the stop loss.

Position Trading

Position traders may use an even wider stop loss, as they are looking to hold positions for months or even years. A wider stop loss ensures that the asset has plenty of room to move without triggering the stop loss.

For example, if you’re position trading a stock that’s currently trading at Rs.50, you might set a stop loss at Rs.40, which would give the stock plenty of room to move before triggering the stop loss.

Tips for Using Stop Losses Effectively

To use stop losses effectively, consider the following tips:

1. Use a stop loss for every trade

It’s important to use a stop loss for every trade you make. Even if you’re confident in your analysis and believe the asset will move in your favor, unexpected events can occur that can cause the price to drop suddenly. By using a stop loss, you’re protecting yourself against these unexpected events.

2. Consider using a trailing stop loss

A trailing stop loss can be a powerful tool for protecting your profits and limiting your losses. By using a trailing stop loss, you ensure that you’re always protecting your profits while still limiting your losses. Trailing stop losses are particularly useful in markets that are trending strongly.

3. Avoid setting the stop loss too tight or too far away

Setting the stop loss too tight can result in unnecessary losses, while setting the stop loss too far away can result in larger losses than anticipated. It’s important to find the right balance between the two.

4. Use stop losses in conjunction with other risk management tools

Stop losses are just one tool in your risk management arsenal. It’s important to use them in conjunction with other risk management tools, such as position sizing and diversification, to help manage your risk and protect your capital.

Conclusion

In conclusion, stop loss orders are a critical tool for any trader looking to protect their capital and manage risk effectively.

By limiting losses, protecting capital, reducing emotional trading, and allowing for risk management, stop loss orders can help traders to make rational decisions based on market conditions and improve their chances of long-term success.

Remember, using a stop loss order is not a guarantee of success, but it is an important step in managing risk and protecting your trading capital. By incorporating stop loss orders into your trading strategy, you’ll be on your way to becoming a more disciplined and successful trader in 2023 and beyond.

So, don’t wait any longer, start implementing stop loss orders in your trades today and take your trading to the next level.

FAQ – Frequently Asked Questions

What is the best type of stop loss order to use?

The best type of stop loss order to use will depend on your trading style and goals. Some common types include market orders, limit orders, and trailing stop orders. It’s important to understand the pros and cons of each type and choose the one that works best for your strategy.

How do I determine the appropriate stop loss level for a trade?

There are several factors to consider when determining the appropriate stop loss level for a trade, including technical analysis, volatility, timeframe, and risk management. Traders should use a combination of these factors to set a stop loss level that effectively manages risk and maximizes potential gains.

Should I always use a stop loss order in my trades?

While using a stop loss order is highly recommended for most traders, there may be situations where it’s not appropriate. For example, if the market is highly volatile and the potential losses could exceed your risk tolerance, it may be better to avoid the trade altogether.

What happens if my stop loss order is triggered?

If your stop loss order is triggered, your broker will automatically close your position at the specified price level. This will limit your losses to the predetermined amount and help protect your trading capital.

Can I adjust my stop loss order after it's been placed?

Yes, many brokers allow traders to adjust their stop loss orders after they’ve been placed. However, it’s important to be mindful of the potential impact on risk management and to adjust the stop loss level accordingly.